What are the advantages of ERC-404?

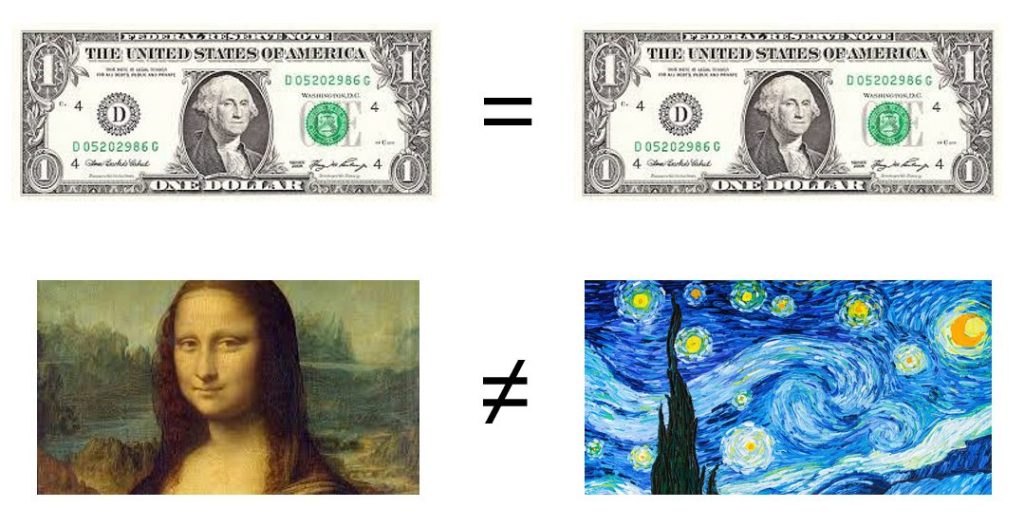

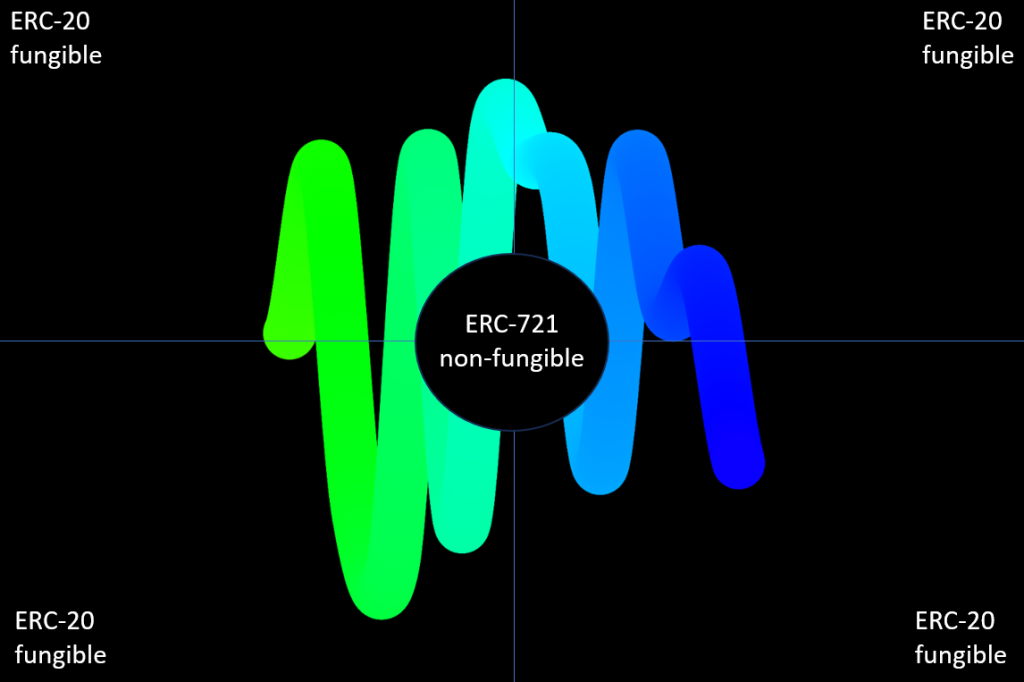

- It combines fungible and non-fungible tokens.

- It brings liquidity into illiquid assets.

- It makes art, especially blue-chip pieces, more accessible.

- It allows for the fractionalization of digital pieces.

- It enables investment in bundles of artworks without the need for membership in a DAO.

When you purchase an ERC-404 token, you are buying an NFT bonded to one or more fungible tokens. For example, if you were to buy a Chromie Squiggle bonded to 4 tokens, you could even buy fractions of it, depending on the implemented token mechanics.

At the moment, if you sell 1 or more tokens, the NFT will be burned and will reappear after you buy back the tokens. We believe that burning is not the right approach yet, but imagine the possibilities with fractional pieces.

Think of it as similar to an ETF. When you buy one share of an ETF, you don’t own Apple, Google, Amazon outright, but you own fractions of the companies.

Art is a cultural store of value that represents the zeitgeist, has historical relevance, and reflects your preferred style.

Possibilities for collectors

If you can’t afford a piece of art outright, here’s an option to save for it. If you want to own a cultural store of value that unites a collective, you have the opportunity to buy a CryptoPunk with your family, so everyone owns a fraction of it, preserving it for the next generation.

You don’t need a DAO to invest in one or more pieces of art. The question is, what kind of collective do you wish to join?

Possibilities for artists

The options for tokenomics are endless. Whether you sell one piece in fractions or 10 pieces in two fractions, the numbers enable various possibilities.

Trigger your collectors with something like a scrapbook as an example. Imagine a superordinate artwork, where you sell other art pieces, akin to trading cards, as fractions.

The scrapbook is only complete if the collector owns all the fractions.

The collector could be an individual or a collective. This approach also opens up more opportunities to attract different types of collectors, including private collectors, institutions, family offices, and more.

It is another way to introduce liquidity to illiquid assets.

The tokens bonded to the NFTs could better represent the price than the actual floor.

Development: On February 12th, developers released the DN-404 token standard. In contrast to ERC-404, which combines fungible and non-fungible functions in one token, both token standards still exist under DN-404 and even function as standalone products.

This new standard reduces gas fees by 20%.

Disadvantages

- It is unaudited, so we wouldn’t recommend investing in these at the moment.

- It could take some time for these tokens to gain acceptance.

- In our view, burning the NFT is not the right approach, as it consumes energy and feels uncomfortable if my NFT is burned. I would always worry about whether my NFT would reappear.

Alternatives

Before the ERC-404, fractionalizing worked like this: you place one or more NFTs into a box and sell portions of that box.

An NFT attached to fractions, represented as liquid and transparent tokens, is much more natural and more comfortable.

Conclusion

Besides the fact that, in our opinion, this token standard is not yet the ideal approach due to the burning mechanism and needs more time to mature and become more secure, it is heading in the right direction.

Ethereum is becoming increasingly important as a tool for ownership in various aspects and offers many possibilities.

It’s interesting for financial products, intellectual property, fractionalizing, transparency, and more.

The list is endless; any tokenomics you can imagine that makes sense could be implemented and accepted by the majority of people.